International Stock Exchange

She'll be really small, but she's great. For it is clear that the Kingdom has great problems, which are only exacerbated. ♪

She'll be really small, but she's great. For it is clear that the Kingdom has great problems, which are only exacerbated. ♪

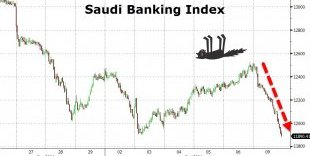

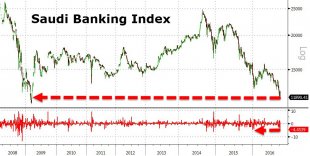

Saudi Arabia continues to seek sources to replenish budget revenues or reduce costs. This is reflected in the banking sector. Shortly the current situation is a panic in the kingdom. Banks ' shares fell after the Government decided to reduce government salaries and bonuses last week, and the central bank ordered banks to restructure credits to those affected by the decision of the authorities.

As a result, the Tadawul core stock index fell to a minimum of 2009.

Saudi Arabia has faced very serious problems due to the fall in oil prices. The largest oil exporter has already allowed late payments to its contractors and has begun to reduce fuel subsidies. All this is done to reduce the budget deficit that this year can reach 13 per cent of GDP and only in 2017 falls below 10 per cent, the International Monetary Fund considers it.

Removing the premiums and allowances, as well as reducing the ministerial salary by 20 per cent, is only the first step in distributing the problems of the kingdom to the population, which in decades of oil abundance has become accustomed to the generosity of the Government. (and now he's going to have to get rid of it, and it's gonna hurt so badly)

However, analysts caution that further economic downturn may increase, which will very much affect consumer confidence. (it will necessarily increase)

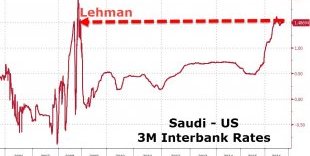

As we see, confidence in the financial sector has already collapsed, reflecting the growth of interbank rates.

Moreover, rising oil prices are no longer helping Saudi Arabia, a big problem. The Forward Market clearly shows that the devaluation of the Saudi riel is unavoidable. And investors buy a record number of contracts protection from defolt. (but default won't save.

The fall of the kingdom continues.