London Exchange Time

The volume of bidding and volatilities change for different currency couples, depending on the movement of hours. You can trade more efficiently if you know what currency couples are at the centre of attention at a given time. Timeing plays a very important role in currency trade.

The volume of bidding and volatilities change for different currency couples, depending on the movement of hours. You can trade more efficiently if you know what currency couples are at the centre of attention at a given time. Timeing plays a very important role in currency trade.

As the foreign exchange market operates 24 hours a day, the trader can closely monitor and respond to each market movement at any time. In order to develop a successful trade strategy, it is necessary to take into account changes in market activity between different currency couples, depending on different time periods. It will maximise trade opportunities during the hours you work for.

In addition, monetary liquidity varies according to geographical location and macroeconomic factors. Knowing how long it is for a currency couple to have the largest and narrowest trading range, you will be able to improve your ability to accommodate capital.

In addition, monetary liquidity varies according to geographical location and macroeconomic factors. Knowing how long it is for a currency couple to have the largest and narrowest trading range, you will be able to improve your ability to accommodate capital.

This article deals with average trade activity by major currency couples in different time intervals. This will help determine when the currency couples are the most volatile.

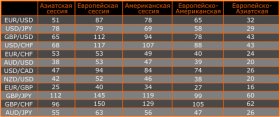

Table below shows the average ranges in points for different currency couples in different time periods

Forex trade activity in Asia is concentrated around several large regional financial centres. During the Asian Trade Session, the largest number of transactions are in Tokyo, followed by Hong Kong, Shanghai and Singapore.

Although the role of the Japan Centre in the currency market has diminished in recent years, Tokyo remains one of the world ' s leading financial centres. When, every morning, tenders are opened in Tokyo, many bidders use their time to assess market dynamics and determine their trade tactics.

Although the role of the Japan Centre in the currency market has diminished in recent years, Tokyo remains one of the world ' s leading financial centres. When, every morning, tenders are opened in Tokyo, many bidders use their time to assess market dynamics and determine their trade tactics.

Often, the Tokyo trade is quite delicate. Large investment banks and hedging funds often use the Asian session to move the market to important stops and options.

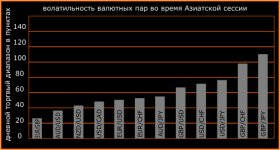

The following table shows the " rallying " of the volatility of currency pars during the Asian trade session.

For the tolerant traders, exchange-rate couples such as USD/JPY, GBP/CHF and GBP/JPY will be traded. A large trading range for these currency pars (average over 80 points) can provide good opportunities for short-term transactions.