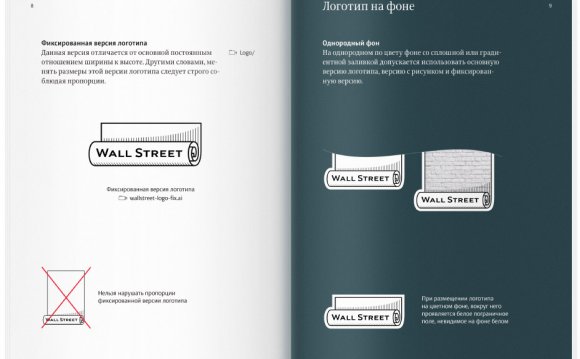

Wall Street Company

At the end of 2015, on the eve of the new year ' s holidays, the Director-General of the online relayer Overstock.com Patrick Birn announced that the United States Securities and Exchange Commission had approved his bloc technology-based equity plan. Patrick Breena's statement was sensational, and the financial world was openly talking about the possibility of using blocks in the industry.

At the end of 2015, on the eve of the new year ' s holidays, the Director-General of the online relayer Overstock.com Patrick Birn announced that the United States Securities and Exchange Commission had approved his bloc technology-based equity plan. Patrick Breena's statement was sensational, and the financial world was openly talking about the possibility of using blocks in the industry.

Technology cannot be described as innovation: the product for which it was created, the cryptopaluta of Bitcoin, has been known to the world since the end of 2008. However, the formal authorization for the use of blocs in securities markets was considered by the experts to be a turning point in the history of the world financial market.

It is expected that, through the use of cryptographic algorithms working on an extensive network of independent computers, the block will help to control more accurately and openly the trade in stocks, bonds and other securities.

Wall Street

The biggest securities dealer in Wall Street, holding Depository Trust Clearing Corporation expressed the wish to merge financial industry organizations to jointly develop block-based software. " Once a few decades, the industry has the opportunity to change: we must rethink the infrastructure and solve its long-standing problems " , the President and CEO DTCC, Michael Bodson, said, " to fully realize the potential of the new data distribution system and avoid confusion, the whole industry must work on it as a coherent mechanism " .Holding Depository Trust " Clearing Corporation " has begun a great deal of business and has become the first financial organization to make an open offer. DTCC co-owners are major financial organizations in and outside Wall Street. The “Financial industry has owned us” is said by the DTCC Chief IT Architect Robert Palatnik, “and all our actions are a response to her challenges”.

In other words, if the Trust " Clearing Corporation is capable of receiving blocks, Wall Street itself will be able to accept new technology. Michael Bodson ' s statement reflects the intentions not only of his company but also of many other financial organizations. And since DTCC controls the de facto state of securities following stock exchange transactions, the corporation is in the best position to start a bloc revolution.

" DTCC seeks to become an organizational centre for the financial sector for bloc supporters " , marked by Josh Gallper, the head of the consulting firm Finadium, whose staff are very sensitive to the development of block technology. DTCC is the expert ' s view that it helps large market players to mobilize and combine their forces to introduce block technology into the securities market.